Net Zero Cloud and its future Carbon Exchange Marketplace

//Note: Diesen Blogpost gibt es auch auf deutsch.//

Summary: Salesforce continues to increase its investment and focus in sustainability by announcing the expansion of Net Zero Cloud into a Carbon Exchange Marketplace towards the end of 2022. This can be interpreted as a strong signal towards a very attractive “all in one” solution for current and future customers who aim to take big steps towards becoming carbon neutral.

On December 9th, Salesforce announced the rebranding of its Sustainability Cloud product to the Net Zero Cloud. This change comes in concert with the Salesforce’s continued commitment to being a net zero company themselves. In addition to the new name, the new sustainability solution has undergone a technical revamp moving from an app available on the Salesforce AppExchange to part of the platform’s “core”. This places the focus of sustainability closer to the heart of the CRM solution. Launching more functionality that matches up to the promise of being the ideal tool, not only measure, but also to reduce a company’s carbon footprint.

In a recent webinar, Kevin Branes, Director of Product Management at Salesforce, announced in a forward-looking statement for the Net Zero Cloud that there would be more changes to come to the platform at the end of 2022. One of the key takeaways is the potential for the inclusion of a Carbon Exchange marketplace. Making an educated guess: it seems Salesforce wants to enable companies to offset the part of their carbon footprint which they cannot reduce to become carbon neutral after having of course measured their footprint around scope 1, 2 and 3 of carbon emissions by acquiring carbon credits.

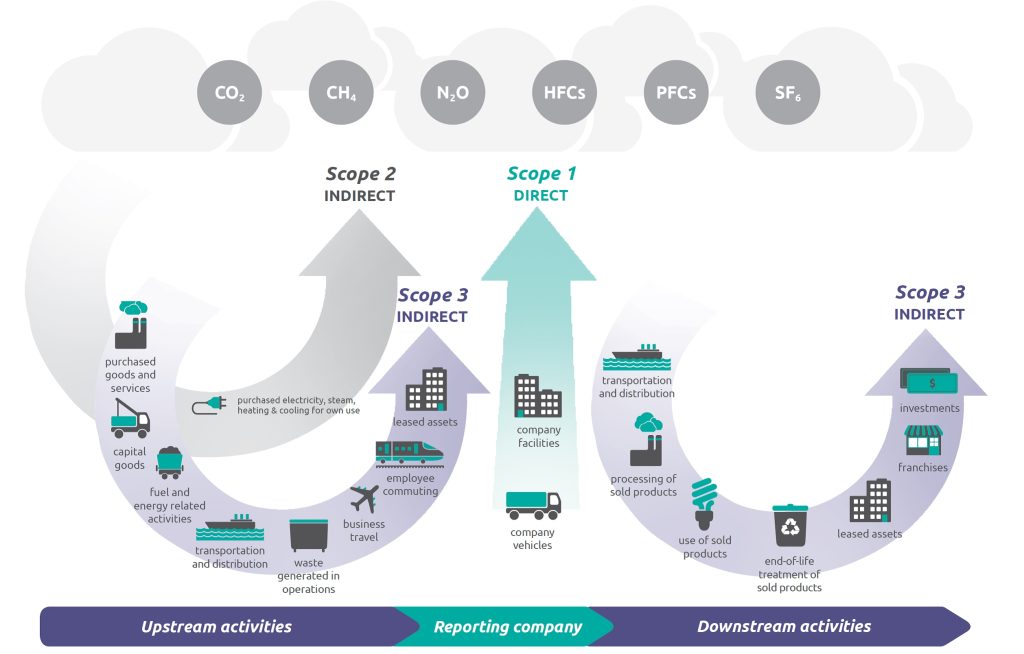

- What does Scope 1, 2 or 3 mean?

- Scope 1 emissions are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organization (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles).

- Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling. Although scope 2 emissions physically occur at the facility where they are generated, they are accounted for in an organization’s GHG inventory because they are a result of the organization’s energy use.

- Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain. Scope 3 emissions include all sources not within an organization’s scope 1 and 2 boundary. The scope 3 emissions for one organization are the scope 1 and 2 emissions of another organization. Scope 3 emissions, also referred to as value chain emissions, often represent the majority of an organization’s total GHG emissions. (source: United States Environmental Protection Agency).1https://www.epa.gov/climateleadership/scope-3-inventory-guidance

Carbon-Accounting — Will Tech-Innovations reach companies before politics?

In an announcement at Salesforce’s largest event of the year, Dreamforce, Marc Benioff, Co-CEO of Salesforce, cited Ursula von der Leyen’s EU Green Deal as a regulation that will be a key driver in promoting carbon footprint reporting for companies. Given this statement it points to the idea that Salesforce is anticipating a big demand for reliable and easy-to-use carbon accounting tools that also facilitate some level of carbon credit management.

“We have to regulate, that's why I love the EU Green Deal, because President Ursula von der Leyen and her EU Green Deal, it requires companies to report the amount of carbon that they are emitting, so right out of our sustainability cloud you get the reports to say here is where you are, and here is where you are going to go”

Marc Benioff, Co-Founder and -CEO of Salesforce, at Dreamforce 2021

Mr. Benioff strengthened his position on Salesforce’s bet on sustainability and carbon offsetting by joining the board of the firm NCX, a Natural Capital Exchange carbon market (previously named SilviaTerra). In further developments, Salesforce is not the only big player at the table. He joins as part of a $20-million funding pact, along with other important investors such as Microsoft Corp’s Climate Innovation Fund.

Will the Net Zero Cloud bring us closer to the Carbon Accounting finish line?

For some companies, the quest for carbon neutrality can bring significant challenges. Purchasing carbon credits can be perceived as an “easy” or short-term solution for companies to fulfil their decarbonization strategy. This is a key challenge for companies, because facing emission reduction can be very costly, and in some cases impossible. Reasons why full decarbonization is impossible come from a variety of areas: from a current lack of innovationaround technology commerce platforms to other mechanisms that promote circular economy as a core part of a business. This is, of course, in addition to the obvious competition factors.

Getting started with carbon accounting is a challenge in itself. With Salesforce’s focus on the Net Zero Cloud as a rising star in their offerings, this sets the stage for many companies to make the investment given the new environmental policies and local regulations coming into place. Salesforce’s upcoming Carbon Exchange Marketplace sets up the global business community to watch in fascination as other new and exciting possibilities bring businesses further on their sustainability journey.

About Ana:

Ana studied Business Administration and later on specialised in IT management back in Mexico, her home country. Before she chose to blaze the trail in Cologne as a senior Salesforce consultant at APTLY for both manufacturing and NGO customers, she gained valuable experience working as an IT business analyst at FLOCERT. Ahead of working for the certification body for Fairtrade in Bonn, Ana was working for many years in mobile app development projects as an entrepreneur in Mexico City where she gained lots of experience working with SMEs and multinational companies. Sustainability is a topic that she holds close to her heart, and she is happy to merge it into every area of her life including Salesforce consulting projects. She loves to paint, cook Mexican food and explore her new beautiful country’s countryside.

image sources:

title picture: Andreas Prott – stock.adobe.com

picture Scope 1,2,3: WRI/WBCSD Corporate Value Chain (Scope 3) Accounting and Reporting Standard (pdf)Exit Exit EPA website, page 5

picture Ana Martinez: aptly.de